Blue Shield: $4000 deductible, no coinsurance, no dental/vision --- $115 (soon) / month

Health Net: $4500 deductible, no coinsurance, no dental/vision --- $65 / month.

Yeah. Blue Shield claims they are losing money in the individual health care market. I don't know what they are doing wrong, but it seems pretty bad. Force health insurance companies to compete by choosing the company with the best rate. It's the only way to keep them honest.

If you are concerned about this isssue, please sign the petition that I have started:

http://health.change.org/petitions/view/stop_unreasonable_health_insurance_premium_increases_from_blue_shield_of_california

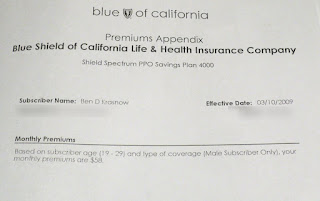

A few weeks ago, I received a 32-page booklet from my health insurer, Blue Shield of California, titled "updates to your health plan." Of course, the updates included higher premiums and less coverage. Today, I received another missive; this time just a two-page letter. Apparently, Blue Shield is so excited about raising rates, they have already issued another rate increase even before the original rate increase has gone into effect. The total premium increase will be a 55.5% increase within a three-month period and a 98% increase since I bought the individual policy in March 2009.

When I first bought health insurance with Blue Shield in March 2009, the policy cost $58. This is almost the least expensive health plan available from any company. It has a $4000 deductible, and I am in the second-cheapest age bracket: 19-29. I also bought a dental plan for an additional $18. At some point in late 2009 or early 2010, Blue Shield raised the health insurance premium to about $75.

When I first bought health insurance with Blue Shield in March 2009, the policy cost $58. This is almost the least expensive health plan available from any company. It has a $4000 deductible, and I am in the second-cheapest age bracket: 19-29. I also bought a dental plan for an additional $18. At some point in late 2009 or early 2010, Blue Shield raised the health insurance premium to about $75.

The letter says that hospital costs went up 15%, and prescription drugs and physician costs went up 12% and 9%, respectively, in 2010. In addition, the letter states that only 2% of premiums contribute to Blue Shield's "net income". Therefore, they must raise my premium by over %55 in the next three months, not including the first rate increase they issued in early 2010 to cover their costs. Either their math is wrong, or I do not understand their definition of "net income."

In early December, Blue Shield sent me the booklet with the chart on the left. It says my premium should be $97, but by late December, Blue Shield had sent another letter and decided the plan should really cost $115. What changed between the first and last week of December? Payroll tax cut? I mean, hey, the government didn't give any sort of explicit tax cut for health insurance companies in this latest round of wild tax cuts, and so insurance companies just needed to step in and take what's rightfully theirs. You know, people will have more money in their pocket due to the payroll tax cut, so they can just send that extra money directly over to their favorite health insurance company. That seems fair.

If you are concerned about this issue, please sign the petition that I have started:

http://health.change.org/petitions/view/stop_unreasonable_health_insurance_premium_increases_from_blue_shield_of_california

so what do we do?

ReplyDeleteWait until you get older it really gets ugly the same policy you have cost 400 for a 40 year old starting in March 2010

ReplyDeleteIt appears that California Insurance "regulators" permitted these unfair rate hikes (see link at bottom). How about we shift some of the cost-burden to the consumer, not unlike other insurance industries. If one chooses to smoke tobacco, regularly drink alcohol in large quantities, or use illicit drugs etc., then shouldn't one expect to pay a higher premium? For those who are unfortunate enough to have a DUI on their driving record, there appears to be no societal objection to the secondary increase in auto-insurance premiums?

ReplyDeleteAs for my Blue-Sh** rates, just 3 years ago I began at $91 per month. However, today I received yet another notice indicating yet another rate increase, my premium is now $229 per month! Furthermore, since beginning my policy I have never used it!

Here is the link that I referenced in the first sentence:

http://www.californiahealthline.org/articles/2010/8/26/state-officials-approve-insurer-proposals-to-increase-premiums.aspx

Roberta, I've already contacted the insurance regulator for California to ask if/why such high rate increases were approved. I haven't heard back yet, but I suspect they were, as the anonymous commenter said. I will also contact Blue Shield and complain/appeal/inquire why the rate increase is so high. Further, I will contact local news outlets and let them know about it. The only way to change things is to speak up and let everyone know about the problem. If everyone keeps quiet, Blue Shield will just keep raising rates without mercy. All the while, they will juggle the books to make it seem as though they only profited 2%. The 2% doesn't include many millions in political lobbying which enables them to make more money, many millions in executive pay, many millions spent on disputing claims, and even more money spent fighting health care reform. Health insurance is probably the worst part about being a small business owner. I've already chosen to be risky by buying such a high-deductible plan.

ReplyDeleteWOW! 58% in three months??? I got 36% in less than three months and thought that was a record. You have to wonder how many more have had this happen to them. 98% since you bought it rings a familiar bell here too. Once they get you it can be hard to switch companies or to a different plan too. Good for you for speaking up. Press needs to get this big time. More in these plans need to pay attention and speak up. Contact your congress person also. I was in your plan for many years (and there were big hikes in previous years also) and I am now in similar 5200 plan with even higher deductible. Never come near the deductible - don't even use all the preventive benefits. Much older than you - much more expensive. Benefit of moving to higher deductible over a year ago was obliterated and then some. CA Depart of Insurance supposedly approved 17% hikes last August or something. An agent said that was an average amount. If that's true why are these plans with big deductibles getting hit the hardest? Just don't get it. Honestly can't afford it. I think they are pumping it up ahead of greater scrutiny next year. Telling me this is because of "reform" had the opposite effect. I would rather buy insurance from the government now. Also paying doctors directly would save me thousands per year. Right now can't afford to go to doctors at all after paying the premiums. Where are the "catastrophic" plans? Scary but may be the only alternative for many. Reform in individual coverage is needed right now in this economy. Many have to work two or three part time jobs or for employers who don't have benefits.

ReplyDeleteI have a family Health Savings Account (HSA) with BS of CA. Several months ago, I thought my premiums were outrageous at $978 per month. Then in October 2010, they raised my monthly premiums to $1,157 per month. Beginning January 1, 2011, my monthly premium is being increased again to $1,407 per month! I thought this was a mistake, but it wasn't. When I called them a couple nights ago, I asked why they are raising the rates so much and their representative said it's because of the new government regulations. Thank you, Mr. Obama!

ReplyDeleteI just sent a letter to the CA Dept of Insurance. It's outrageous! I am 50 years old. I accept the increase once I turned 50. I am very healthy and a resting heart rate of 58. I don't smoke and exercise and live a relative healthy lifestyle.

ReplyDeleteMy increase is 38.9%. But it has really increased about 74% since June 2010!

This is what we get for being self-employed or small business owners!

I am livid!

Greetings Ben~

ReplyDeleteI really appreciate this blog entry. In October I switched my plan to a less expensive one... now of course my "cheaper plan" will cost just as much as my old one...

Would you like to work with me to start a petition through Change.org?

I think even just copying some of your words in the first paragraph of this entry would work. Is there an email address I can reach you on?

We must say no more!

I too am livid.

Blessings~

Aliana, sure you can reach me at ben at magconcept dot com. I'd be very interested in starting a petition.

ReplyDeleteHealth insurance companies that operate for profit will do everything they can to raise rates, deny care, drop patients, spend money lobbying for less regulation so that they can continue to raise rates, deny care, etc. A single-payer system makes a lot of sense since it would take the profit motive out of health care (ie Medicare for everyone). The health insurance industry along with their republican friends did an amazing job of smearing a single-payer system that would have transferred money from insurance companies to American citizens. It baffles me how people can vote against their own interests, and because of this, we now have a health insurance system that can raise rates by 50% in a year and use that money to fund future political activism, executive salaries, and shareholder profits. In a third-world country, it would be considered outrageous extortion, but in the USA it's considered a free market.

Insurance companies are killing people. No one can afford high Insurancerates or the stress of the increased rates. They are supposed to protect you, not add to your health problems! It is insane!

ReplyDeleteI got a 43% increase starting 1st March from Blue Shield of CA. Let me know if there's a common place we could all send our complaints to for more impact.

ReplyDeleteContact the California Department of Insurance and congress. The increases that get reviewed next year - anything over 10% -the ones that don't start until this year - look smaller on paper - the really big increases happened over the last year (and in previous years) and especially at the end of this year after they were suposedly reviewed and approved for 18% or so (39% increase by Blue Cross and others was denied). Blue Shield said they raised it only 13% last year. Now Blue Shield said that was just an average. So why are the high deductible self paid plans (where you pay everything out of pocket anyway) getting 55% and 74%? The self paid people are stuck and have been paying the whatever rate for years. No way did expenses go up that much in three months or one year in these plans. More need individual insurance than ever before. More than ever cannot afford it. The reform should only be 1% higher so what is going on? Sinking feeling nothing can be done. Waiting until 2014 is not an option for many who may end up without any insurance at all.

ReplyDeleteBlue Shield sent me a letter on 11/30/10 stating that effective 02/01/11 my monthly rate will increase $43/month. A few days later I received another letter stating affective 02/01/11 my rate would increase $128/month. Today I received yet another letter this time with an increase of $184/month or 97.9% increase from what I am paying today effective 03/01/11.

ReplyDeleteHow in the world is this legal? I have been to the doctor once since I started my coverage with Blue Shield in March of 2009.

If you are concerned about this issue, please sign the petition that I have started:

ReplyDeletehttp://health.change.org/petitions/view/stop_unreasonable_health_insurance_premium_increases_from_blue_shield_of_california

Blue Shield will raise my premium 59 percent on March 1. Duke Helfand of the LA Times may be doing a story on this--I recommend everyone contact him.

ReplyDeleteBut we also need to get our friend, who are blissfully covered by their company's medical plans, to get involved/outraged etc. Remind them that they won't be getting raises soon––partially because their company pays so much for the medical insurance.

I have almost the exact same situation as Ben - the health insurance companies are continuing to rip people off to pad their bottom line. Thanks for bringing this problem up and having the good info & links.

ReplyDeletelooks like it is being reported in the news---http://www.latimes.com/health/healthcare/la-fi-insure-rates-20110106,0,6975599.story

ReplyDeleteben--- is there a way to change the petition title to say : Stop unreasonable health insurance rate hikes from Blue Shield of California

that way when people google-- "rate hikes blue shield of california" that will pop up.

let's hope since this hike is under review they will not let it pass

Aliana, that's a good idea. I've changed the title, and hope that Google will rank it higher in the search results.

ReplyDeleteI heard back from the CA department of insurance today, and they said I should file a formal "request for assistance", which I did. They insist on a mailed form that includes supporting documentation (notice of rate increases), and so I mailed the whole packet today. We'll see what happens.

Hey Ben.

ReplyDeleteI am trying to reach you. I am a reporter with Kron 4 News and we are doing a story on the rate hikes from blue shield today.

Please contact me asap at kthompson@kron4.com

THanks.

Newly elected CA Insurance Commissioner Dave Jones will speak with KPFA Livingroom co-host Ellen Shaffer on Friday Jan. 7 around 12:15. FM 94.1 in the San Francisco Bay Area or online at www.kpfa.org.

ReplyDeleteSingle payer is what is needed.

ReplyDeleteCheck out www.singlepayernow.net and SB810 authored by Sen Mark Leno.

ReplyDeleteHi folks,

ReplyDeleteI do a lot of teaching in the US health care system. There is a tremendous and disproportionate amount of the health care dollar that goes to the administrative infrastructure.

As much as many US citizens seem to fear government intervention, most civilized countries in the developed world have "Universal Health Care" and typically as a "single payer" funded system.

My American medical colleagues often ask me "do we really have as much to fear in a "Canadian Model of Universal Health Care?" and the answer is the same. I wouldn't be working in it, if I didn't believe it delivers the best balance between excellence and cost. There is so much rhetoric that is in the (primarily conservative) media that is so far from the truth, it saddens anyone looking from outside your system.

You simply can't lose everything because of a lack of healthcare insurance. The uninsured and a growing number of "under insured" Americans is obscene.

To the question of "relative risk" pay structures - for those who have the "right" to supersize every fast food meal they get or those who abuse alcohol and/or tobacco and other drugs, the analogy to auto insurance premiums simply doesn't hold. It is not a basic human right to drive a car. It is a privilege. Healthcare is NOT a privilege, it is a right. It isn't something that can be generously given to a select few who deserve it. It must be available to all.

Anyway, that's one MD's views from the other side of the US-Canada border :)

Good luck,

Doug

nitrous, I would love to have a single-payer system. Originally, this is what Obama proposed, but over the course of the debate, he moved so far away from the initial goal, that the current "controversial" reform seems like a very small change.

ReplyDelete@Ben

ReplyDeleteso what is your premium now, 4 years later? Mine here in MA is ~$800/mo w $4000 deductible-one of the cheapest available.

@nitrous

Why should we make the public pay for our poor private health choices (smoking, alcohol , lack of exercise, etc). I agree that catastrophic health care is a right but much of disease today is due to lifestyle impacting genetics.

Currently with Blue of California. Family of 4, two adults, two dependents, "Bronze" PPO, $643.35 for adults, $306.29 for dependents, coming to $1924.60 per month for low tier coverage. Dental is another $216 per month. I'm sure it will get better, our politicians are not in the hands of insurance companies, right? Right?

ReplyDelete